Source from: New Straits Times, Original Article

The local property market is set for recovery, according to the National Property Information Centre (NAPIC).

Napic said the acceleration of the National COVID-19 Immunisation Programme and the ability to achieve National Recovery Plan threshold across the states will see the reopening of more economic and social sectors in the fourth quarter of 2021.

“Supported by the implementation of various government initiatives and assistance, the property market is expected to be on the recovery path in line with the gradual economic recovery,” it said.

Napic said the property market had performed better in the first half of 2021 (1H 2021) compared to the same period last year.

The Malaysia Property Market Report for 1H 2021 released today showed 139,754 transactions worth RM62.01 billion recorded in 1H 2021. This was 21 per cent higher in volume and 32.1 per cent more in value than the same period last year.

Napic said that the volume of transactions across the sub-sectors showed upward movements.

Residential, commercial, industrial, agriculture and development land sub-sectors recorded year-on-year (YoY) growths of 22.2 per cent, 28.5 per cent, 29.4 per cent, 13.9 per cent and 21.3 per cent, respectively.

Value of transactions moved in tandem with residential, commercial, industrial, agriculture and development land sub-sectors, recording growth at 34.7 per cent, 28.4 per cent, 19.8 per cent, 33.1 per cent and 40.6 per cent, respectively.

“The residential sub-sector led the overall property market, with 65.8 per cent contribution,” said Napic.

This was followed by the agriculture sub-sector (18.9 per cent), commercial (7.5 per cent), development land (5.9 per cent), and industrial (1.8 per cent).

In terms of value, residential took the lead with 55.6 per cent share, followed by commercial (17.6 per cent), industrial (10.4 per cent), agriculture (8.9 per cent) and development land (7.4 per cent).

Residential

The report stated there were 92,017 transactions worth RM34.51 billion recorded in the review period, increasing by 22.2 per cent in volume and 34.7 per cent in value YoY.

All states recorded higher market volume except for Wilayah Persekutuan Putrajaya.

The four major states, Kuala Lumpur, Selangor, Johor and Penang, recorded about 50 per cent of the total national residential volume.

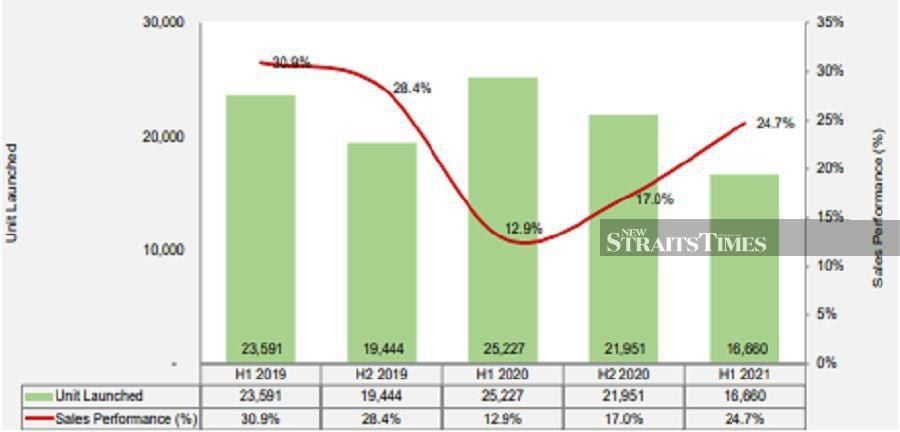

In terms of new launches, there were 16,660 units launched in 1H 2021. This was 34 per cent lower compared with 25,227 units launched in the same period last year.

The sales performance for new launches was 24.7 per cent better compared to 1H 2020.

Selangor recorded the highest number of new launches in the country, accounting for nearly 24.7 per cent (4,114 units) of the national total with sales performance at 26.2 per cent followed by Kuala Lumpur with 3,651 units or 21.9 per cent share with sales performance at 3.5 per cent.

Terraced houses dominated the new launches. Single-storey (2,624 units) and two to three-storey homes (5,455 units) contributed 48.5 per cent of the total units, followed by condominium/apartment units at 41.4 per cent share (6,893 units).

Napic attributed the improvement in sales performance to various measures by the government, such as reintroducing the Home Ownership Campaign (which now ends on December 31, 2021) and low Overnight Policy Rate (1.75 per cent).

Other measures include full stamp duty exemption on instruments of transfer and loan agreement for first-time homebuyers up to December 31, 2025, RPGT exemption for disposal of residential homes up to December 31, 2021, uplifting of the current 70 percent margin of financing limit applicable for the third housing loan onwards for property valued at RM600,000 and above, and Rent-to-Own Scheme for 5,000 PR1MA houses worth over RM1 billion.

Napic noted that on the demand side, the number of loan applications and total loan approval for the purchase of residential property in H1 2021 increased 86 per cent and 92.6 per cent, respectively. However, the percentage of approval against application was moderate at 35.3 per cent.

Overhang property

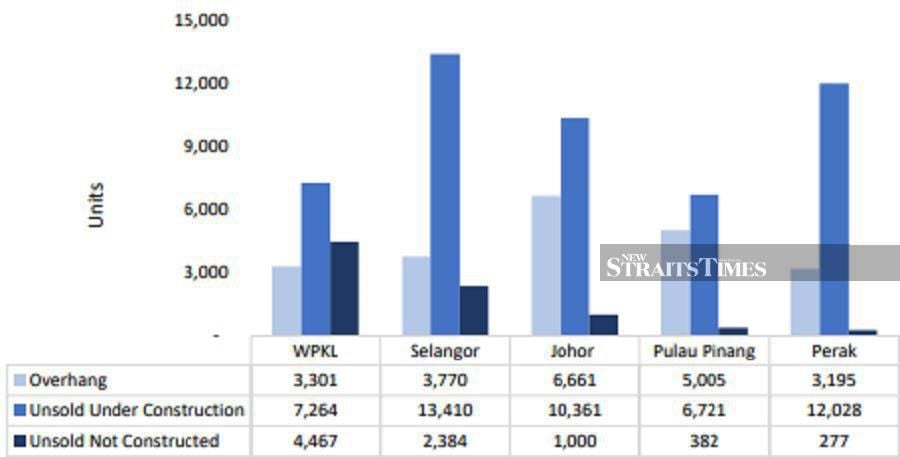

According to the report, the residential overhang exhibited a moderated growth. A total of 31,112 overhang units worth RM20.09 billion was recorded, showing an increase of 5.2 per cent and 6.2 per cent in volume and value, respectively, against the preceding half.

Likewise, the unsold under-construction residential units saw an increase of 4.3 per cent to 74,844 units compared to H2 2020 (71,735 units).

The report showed that Johor retained the highest number and value of overhang in the country with 6,661 units worth RM5.02 billion, accounting for 21.4 per cent and 25 per cent in volume and value, respectively, of the national total.

Penang came in second with a 16.1 per cent share (5,005 units; RM3.85 billion), followed by Selangor with a 12.1 per cent share (3,770; RM3.27 billion).

Condominium/apartment formed 58.5 per cent (18,195 units) of the national overhang, followed by terraced (24 per cent; 7,323 units).

Napic stated in the report that the high-end price range at more than RM500,000 took up the largest share, accounting for 46.6 per cent (14,511 units) of total overhang.

Properties priced at RM300,000 and below accounted for 27.1 per cent (8,439 units), while those ranging from RM300,000 to RM500,000 took up 26.2 per cent (8,162 units).

Commercial transaction

There were 10,433 transactions worth RM10.93 billion recorded in 1H 2021, up by 28.5 per cent in volume and 28.4 per cent in value compared to the same period last year.

Napic stated that all states recorded more market activity in the review period except for Putrajaya and Pahang.

In terms of transaction value, five states recorded contraction, but the increase in Selangor (40.3 per cent), Kuala Lumpur (47.6 per cent) and Johor (18.3 per cent) led to the overall rise in the sub-sector.

Selangor contributed the highest volume and value to the national market share, with 26.3 per cent in volume (2,741 transactions) and 30.8 per cent in value (RM3.37 billion); followed by Kuala Lumpur with 13 per cent in volume (1,359 transactions) and 28.2 per cent in value (RM3.08 billion) and Johor with 13.5 per cent in volume (1,410 transactions) and 11.6 per cent in value (RM1.27 billion).