Author: Ir. Dr. Justin LAI Woon Fatt | 27 June 2024

INTRODUCTION

The data centre market in Malaysia has experienced significant growth over the past decade, driven by increasing digital transformation, cloud adoption, and the demand for robust IT infrastructure. Malaysia’s strategic location, favourable government policies, and strong digital ecosystem make it an attractive destination for data centre investments. According to a report by international tech research firm, Tech Navio, the market for data centre in Malaysia is expected to grow at a compound annual growth rate (CAGR) of 13.92% in the following 5 years from US$ 1.81 billion in 2023 to US$ 3.97 billion in 2029 [1]. In addition, Malaysia government is now encouraging RM 70 billion in investments in digitalization, which is expected to generate up to 500,000 jobs and contribute 22.6% of Malaysia’s GDP by 2025 [2].

WHY CHOOSE MALAYSIA?

As Malaysia’s construction cost stands around $8.5 million – $10 million per MW, it is cheaper than those in Singapore and Jakarta in the Asia-Pacific region [3]. Additionally, the government offers a variety of incentives, making it an attractive destination for data centres due to its low likelihood of natural disasters, affordable electricity, and ample land availability. Data Centres companies may qualify for Malaysia Digital (MD) status, which provides benefits including foreign quality restriction exemptions, allowance for the employment of foreign workers, income tax exemptions, exemption on import duties for multimedia equipment, and most importantly investment tax allowance [4].

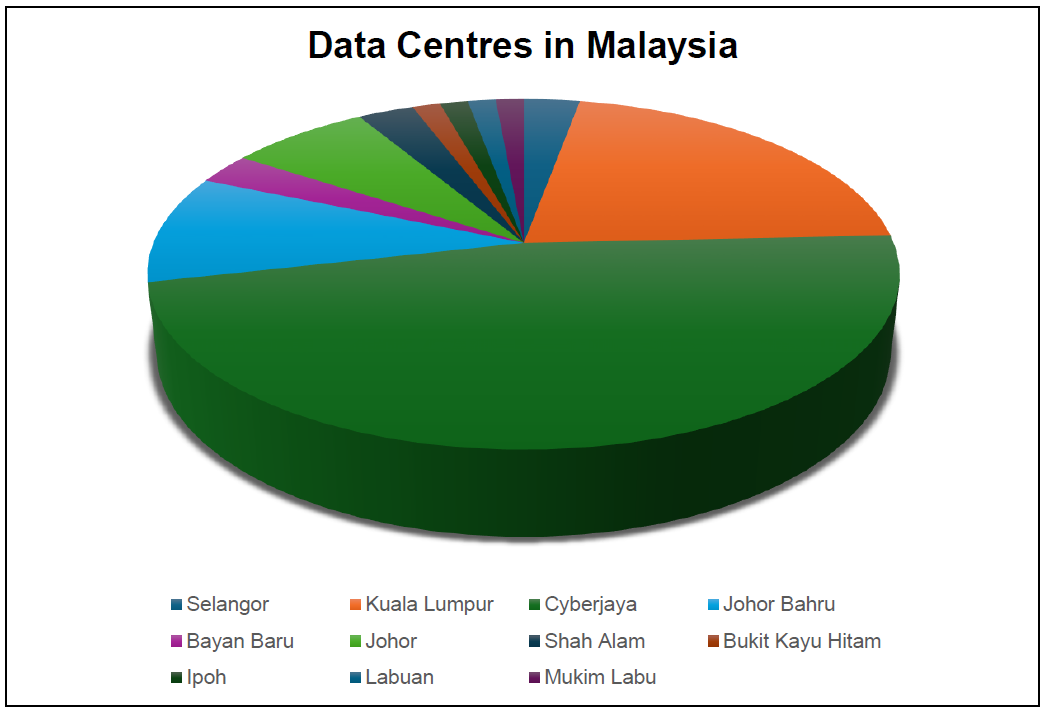

According to Data Centre Map’s research as of July 4, 2024, Malaysia currently boasts 70 data centres [5]. Among these, around 34 are operational colocation data centres, with a majority developed to Tier 3 standards. [3] Based on the pie chart provided, Cyberjaya has the largest number of data centres in Malaysia, making up 47% of the total.

POTENTIAL MARKET DATA CENTRE IN MALAYSIA

Recently, Google has pledged to invest US$ 2.2 billion in constructing hyperscale data centres (HDCs) at Elmina Business Park by Sime Darby Property Bhd. Generally, HDCs can accommodate over 5,000 servers, enabling cloud service providers (CSPs) to process and store vast amounts of data [6]. Due to Singapore limits on HDC construction because of high electricity and water consumption, investors are now targeting Johor, Malaysia, which is strategically located near Singapore. Malaysia currently has a data centre capacity of between 120 MW and 150 MW where there will be an additional of 150 MW due to increasing global tech investment in the country [7].

POWER DEMAND

According to statistics, China Telecom’s Inner Mongolia Information Park is the world’s most energy-consuming data centre, using 150 MW of energy [8]. Each rack in this data centre consumes around 16.7 kW of energy [9]. With the shift to AI servers, data centre electrical consumption in the USA is expected to rise, reaching 35 GW by 2030, up from 17 GW in 2022. This statement is strongly supported, as current racks consume between 10 and 14 kW, while AI-ready racks could use 40 to 60 kW due to their resource-hungry GPUs. [9]. This shows that there will be an increment of 294.12% in power demand if AI servers are switched.

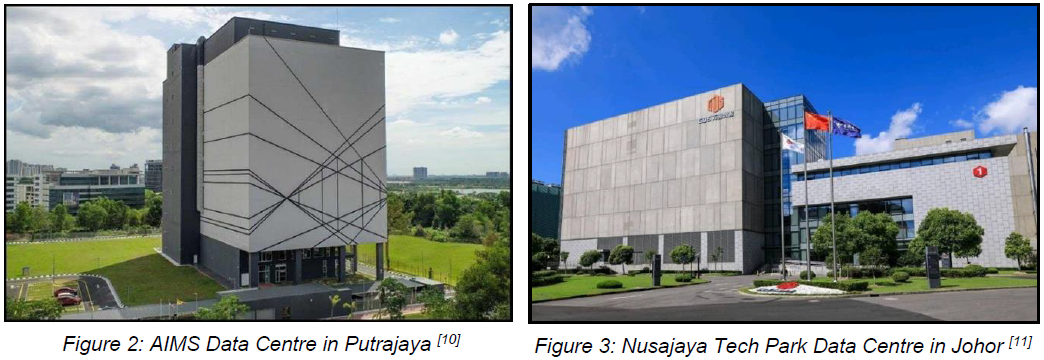

Figure 2 shows the AIMS Data Centre in Putrajaya, a 240,000 square feet Tier 3 facility utilizing 50 MW of power [12]. Similarly, Figure 3 presents the Nusajaya Tech Park Data Centre in Johor, owned by GDS Holdings Ltd., which also spans 240,000 square feet but requires a higher power consumption of 69.5 MW [13].

Economists highlight Malaysia’s robust electricity infrastructure, with a power reserve margin slightly above 40%, sufficient to meet the demands of data centres [14]. On the other hand, the Head of Digital Infrastructure Department, Digital Enablers Division from Malaysia Digital Economy Corporation (MDEC) announced plans to enhance connectivity among data centres in Johor through submarine optic fibre cables [15]. Additionally, as the main electricity supplier, TNB (Tenaga Nasional Berhad), is confident in managing the projected increase in power demand from data centres, which may exceed 4,300 MW. The company has agreements with four data centre companies—Air Trunk Malaysia Sdn Bhd, YTL Power International Bhd, GDS IDC Malaysia Sdn Bhd, and Yellowwood Properties Sdn Bhd—totalling a demand of 1,500 MW, all based in Johor [16].

WATER DEMAND

Due to cooling and humidification systems playing a major role in maintaining an optimum atmosphere for the server devices to function properly, the water consumption of an average data centre is high. Amazon Web Services (AWS) reports that their data centre use 1.8 L per kilowatt-hour, a measurement termed “Water Usage Effectiveness” (WUE). WUE is a critical metric for accessing the water efficiency of data centres based on the energy consumed by the IT equipment, which derives an expression of litres per kilowatt-hour (L/kWh) [17]. As reported by Bernama in 2023, the average WUE for data centres in Singapore is 2.6 L/kWh, while the global average WUE for data centres is around 3.5 L/kWh. Based on calculations, a 100 MW data centre in Singapore with a WUE of 2.6 L/kWh would use approximately 6,240,000 litres of water per day, which equals to 6,240 m³/day.

DUE DILIGENCE STUDY

As stated before, service providers in Malaysia are ready to manage large resources of power and water for operating data centres, but pre-consultation must be carried out accordingly. Prior to the final decision to acquire land, it’s important for an investor to hire an engineering consultant to conduct a due diligence study. The engineering consultant plays an important role in studying the power and water usage based on the client’s equipment specifications. Furthermore, having those data specifications allows the pre-consultation process to run smoothly with TNB and the water supply company, where the engineering consultant can consult the parties to ensure the availability of infrastructure for the new facility. Through this discussion, the service provider can decide the most optimal route to deliver the required infrastructure to the site. Ultimately, the engineering consultant will provide the client with an estimate of the time and cost of delivering the infrastructure to the chosen site based on the service route proposed by the provider.

Besides considering infrastructure, the engineering consultant must also engage in pre-consultation with the local government (Majlis Bandaraya) such as the PLANMalaysia (Jabatan Perancangan Bandar dan Desa) and the Building Department (Jabatan Bangunan) on the special requirements of such development. It is crucial to carry out these steps to understand local government concerns about the proposed data centre and possible conditions to be imposed during the submission of development order approval, building plan approval and infrastructure approval for the development of the facilities in the future. By conducting a thorough due diligence study, the engineering consultant can guide the investors to make wise decisions, ensuring cost and time efficiency in the construction of a data centre in Malaysia, and most importantly, the construction process can run smoothly.

CONCLUSION

In conclusion, as digitalization advances in this society, the importance of data centres is becoming more significant. Malaysia shows huge potential in this market due to its low construction cost, and most importantly, the availability and efficient cost of power and water resources for the operation. By understanding the high demand for water and power in data centres, a thorough due diligence study by an engineering consultant is essential to avoid wrong decisions that may lead to failure or consequences in spending more money to obtain infrastructure. With the aid of an engineering consultant, the construction cost, time, methods, etc. will become clearer, allowing investors to obtain the necessary infrastructure for their data centres.

Ir. Dr. Justin LAI Woon Fatt

CEO/ Founder

IPM Group

References:

[1] Yahoo Finance. (2024, April 25). Malaysia Data Center Market Analysis 2024-2029 : Malaysia is Among the Top Expensive Market Globally for Developing Data Centers. Retrieved on 27 June 2024 from https://finance.yahoo.com/news/malaysia-data-center-market-analysis-081300704.html

[2] Industrial Malaysia. (n.d). Step-by-Step Guide to Setting Up a Malaysia Data Centre. Retrieved on 27 June 2024 from https://www.industrialmalaysia.com.my/article/malaysia-data-centre

[3] Asean Briefing. (2024, May 30). Google to Invest US$2 Billion in Malaysia’s Data Centre and Cloud Market. Retrieved on 27 June 2024 from https://www.aseanbriefing.com/news/google-to-invest-us2-billion-in-malaysia-data-center-and-cloud-market/

[4] Skrine. (2024, April 3). Investment in Data Centres in Malaysia. Retrieved on 27 June 2024 from https://www.skrine.com/insights/alerts/april-2024/investment-in-data-centres-in-malaysia

[5] Data Centre Map. (n.d). Malaysia Data Centre. Retrieved on 27 June 2024 from https://www.datacentermap.com/malaysia/

[6] The Star. (2024, May 31). M’sia secures RM 9.4bil Google Investment. Retrieved on 27 June 2024 from https://www.pressreader.com/malaysia/the-star-malaysia/20240531/285413471590038

[7] Ministry of Communications. (2023, August 20). Data Centre Boom. Retrieved on 27 June 2024 from https://www.kkd.gov.my/en/public/news/19801-data-centre-boom

[8] Sunbird. (n.d). Top 10 Energy-Consuming Data Centers. Retrieved on 27 June 2024 from https://www.sunbirddcim.com/infographic/top-10-energy-consuming-data-centers

[9] DCD. (2022, May 18). In search of the world’s largest data center. Retrieved on 27 June 2024 from https://www.datacenterdynamics.com/en/analysis/in-search-of-the-worlds-largest-data-center/

[10] Mission Critical. (2022, December 19). Aims data center aims for excellence. Retrieved on 27 June 2024 from https://www.missioncriticalmagazine.com/articles/94408-aims-data-center-aims-for-excellence

[11] The Star. (2021, July 16). GDS Holdings to develop hyperscale data centre in Johor. Retrieved on 27 June 2024 from https://www.thestar.com.my/business/business-news/2021/07/16/gds-holdings-to-develop-hyperscale-data-centre-in-johor

[12] AIMS. (n.d). AIMS Cyberjaya. Retrieved on 27 June 2024 from https://aims.com.my/cyberjaya/

[13] GDS. (2023, August 10). GDS providing platform for the technology that is transforming China. Retrieved on 27 June 2024 from https://www.gds-services.com/en/newsshow_82.html

[14] Birruntha, S. (2024, May 22). Powering growth potential: New straits times. NST Online. Retrieved on 27 June 2024 from https://www.nst.com.my/business/economy/2024/05/1053768/powering-growth-potential

[15] The Edge. (2024, June 6). JLL Malaysia anticipates more data centre developments across Malaysia due to rising demand. Retrieved on 27 June 2024 from https://theedgemalaysia.com/node/714408

[16] The Edge. (2023, October 30). Tenaga can meet demand. Retrieved on 27 June 2024 from https://www.tnb.com.my/assets/newsclip/30102023b.pdf

[17] Tech Target. (2024, January 17). How to manage data center water usage sustainably. Retrieved on 27 June 2024 from https://www.techtarget.com/searchdatacenter/tip/How-to-manage-data-center-water-usage-sustainably